Abstract

From the perspective of both plaintiffs and defendants, the measurement of damages quantum is arguably of the utmost importance. Therefore, it may be surprising to learn that this process is left entirely to the court’s discretion. This results in each litigation becoming a unique case calling for a sui generis outcome, which leads to unnecessary litigation and uncertain judicial decisions. As such, there is a need for alternative methods that are both objective and simple.

Based on the results of an empirical analysis of several hundreds of precedent cases from American common law, French civil law, and International commercial law, this article formulates simple and practical suggestions for parties looking to improve their chances of success in recouping lost profits and lost opportunities.

I demonstrate a clear negative correlation between the quantum of the plaintiff’s claim and its outcome: the gap between the claim and defense widens when the claim increases. The court’s decision logically reflects this wider gap. Second, I establish that the methodology used by the claimant in support of its claim has a concrete impact on the outcome. Thirdly, claimants operating in mature industries seem to have better chances of being granted damages than those operating in riskier businesses.

Once validated on a larger sample and more widely shared, those results may benefit the academic debate, as well as courts and judges as tools to assist their rulings. Finally, the parties and their attorneys can use those results ex-ante, when drafting their contracts, to minimize the risk of dispute. They can also be used ex-post, when a dispute emerges, to settle or to optimize their outcome in case of litigation.

In conclusion, I suggest that continuous empirical research on certain types of commercial damages combined with the use of AI—particularly natural language processing and machine learning techniques—could lead to compensatory schedules with high predictive power.

Table of Contents

I. ACKNOWLEDGEMENTS

II. INTRODUCTION

III. LITERATURE REVIEW

-

- Theories and Case law in United States Law

- Theories and Case Law in French Civil Law

- Theories and Case Law in International Commercial Law

IV. METHODOLOGY

-

- Methodological Challenges to Research

1.1 Sample Size Limitation

1.2 Selection Biases

-

- Sample Description

2.1 United States

2.2 France

2.3 International Commercial Law

-

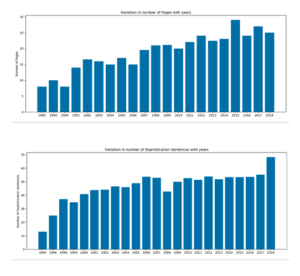

- Trends Overtime in Each Jurisdiction

- Criteria Influencing the Outcome Across Jurisdictions

- Types of damages

V. HYPOTHESES

VI. EMPIRICAL RESULTS

-

- Convergence Over Time Between Jurisdictions

1.1 Observations

1.2 Globalization

1.3 The Trend in the United States

1.4 Trend for France

1.5 Possible explanations

-

- Analysis

2.1 Quantum Value of Claim

2.2 The Sophistication of the Claimant’s Methodology

2.3 Claimant’s Business Risk

2.4 Claimant’s Reputation

2.5 Law Firm Size

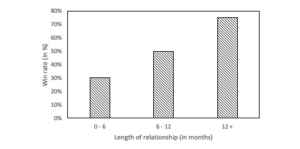

2.6 Length of Relationship

VII. CONCLUSION

VIII. APPENDIX

- Convergence Overtime Between Jurisdictions

- Single Variable Analysis

- Comparison Through Two-Variables Functions

- Sophistication overtime on 8,000 cases

- Multivariate analysis — Control for the claim

IX. LIST OF FIGURES AND TABLES

I. Acknowledgements

The author would especially like to thank the Chair of his advisory committee, Professor Avery Katz, and his advisors, Professors Eric Talley and Alejandro Guarro, who actively contributed to his research at Columbia Law School. The author also thanks Professors Jonathan Askin, Laurent Aynès, Aditi Bagchi, Mark Barenberg, George Bermann, Patrick Bolton, Anu Bradford, Richard Brooks, David Capitant, Suzanne Carval, Robert Cottrol, Albert Choi, Joan Divol, Philippe Dupichot, Bénédicte Fauvarque-Cosson, Joel Feuer, Martin Gelter, Ronald Gilson, Victor Goldberg, Jeffrey Gordon, Anne Guégan, Georges Haddad, Stephen Halpert, Geneviève Helleringer, Sophie Hocquet-Berg, Patrice Jourdain, Jeremy Kessler, Caroline Kleiner, Alan Koh, Russell Korobkin, Yves-Marie Laithier, François-Xavier Lucas, Stefano Manacorda, Daniel Markovits, Thomas Merrill, Joshua Mitts, Sophie Robin-Olivier, Christina Ramberg, Alex Raskolnikov, Joel Reidenberg, Paul Rogers, David Rosenbloom, Darren Rosenblum, Gregory Rosston, Jeffrey Fagan, Carol Sanger, Robert Scott, Ruth Sefton-Green, David Schizer, Steve Thel, Ran Tryggvadottir, Christina Tvarno, Liliane Vana, Pascal de Vareilles-Sommières and Timothy Webster for their generous advice. The extends his thanks to the participants in the Law & Economics Workshop of October 9, 2017, in the Remedies lecture of December 7, 2017, in the Associates Forum of February 14, 2018 and March 6, 2019 at Columbia Law School, the participants in the ASCL YCC Conferences of April 21, 2018, May 11, 2019, and October 8, 2022 respectively at Case Western Reserve University School of Law, McGill University School of Law, and Northeastern School of Law, the participants in the Law & Economics Seminar of March 21, 2019 at Sydney University School of Law, the participants in the Law Incubator & Policy Clinic Seminar of April 3, 2019 and October 2, 2019 at Brooklyn Law School, the participants in McGill Graduate Law Conference of May 9, 2019, and the participants in the Causal Inferences Workshop of August 12-16, 2019 at Duke University School of Law for their constructive comments. Many legal practitioners had the kindness and patience to participate in the field interviews: Forrest Alogna, Laurent Aynès, Claude Bendel, Cyril Bonan, Emmanuel Brochier, Matthieu de Boisseson, Pascal Chadenet, François Château, Adam Emmerich, David Katz, Alain Maillot, Olivia Maginley, Ryan McLeod, Jonathan Moses, Christian Pierret, David Rosenbloom, Paul Saunders, William Savitt, Richard Schepard, Christine Sévère, attorneys, Claire Karsenti and Maurice Nussenbaum, expert witnesses, and Norbert Giaoui, general counsel. The author is grateful to Jennifer Bader for legal translation services, to Maxime Delabarre and Diego Lobo for excellent legal research and editing assistance, to Luv Aggarwal, Jòan Gondolo and Philippe Lachkeur, co-founders of Optimalex, and to his research assistants, mostly brilliant students at or graduate from Columbia, Paris 1 and Yale : Amey Ambade, Mohini Banerjee, Salomée Bohbot, Unique Cheon, Tonbara Ekiyor, Satvik Jain, Megan Ji, Jordan Johnson, Mickael Le Borloch, Sophie Moskop, Ana Carolina Nakamura, Vasile Rotaru, Swara Saraiya, and Alaap Sivaram who provided substantial assistance in extracting, coding and analyzing hundreds of cases.

II. Introduction

The assessment of economic loss and compensatory damages for contract breach has traditionally navigated between two practical difficulties: judicial uncertainty and technical complexity. Judicial uncertainty is particularly high when objective data is missing. When data does exist, current financial and statistical methodologies are too complex and costly for most cases. This leads to inefficient bargaining, unnecessary litigations, and/or unpredictable judicial decisions. Hence, there is a need for alternative methods that are both objective and simpler than current quantitative methods.

One of those methods would be to develop damages schedules for certain types of economic losses as they exist for personal injury. A good way to start is to study case law and survey rulings that can be used as precedents for different types of economic damages. As it has been developed in a previous article,1 the traditional approach towards damages considering them only as a question of fact is limited and potentially arbitrary. In this case, considering the valuation of damages also as a question of law, following rules and methods, appears to be an interesting alternative.

The foundation of this research goes back to a professional experience several years ago when I was advising a clean-tech start-up in its private placement. After an auction process, my client entered into an exclusive agreement to negotiate with a corporate venture fund. The exclusivity period was extended twice. Eventually, the parties reached an agreement on the business plan, and the fund committed to invest in equity with no condition precedent. The investment contract was signed but was never performed by the fund. As all alternative investor candidates had vanished, the start-up went bankrupt. After an unsuccessful attempt to settle, the client filed a lawsuit for breach of contract claiming full compensatory damages. They were merely granted partial compensation for their advisory fees and all expectation and consequential damages were denied because they were considered too speculative.

I selected three types of business situations where I think the use of simple quantitative methods is most relevant to assessing damages: breach of an agreement to negotiate, damage to commercial reputation, and lost profits for a new business. For each of those situations, I designed a hypothesis of the relations between certain factual variables and the judicial outcome. Next, I searched and identified several hundred relevant cases and built a comprehensive database. Then, I used the database to validate or amend the initial hypotheses, identify patterns or correlations, and suggest damage ranges or scales.

In the previous article, I argued that the valuation of damages should be considered both a question of law and fact.2 Literature is abundant on the theory of liability in contracts but is much sparser concerning damages. In France, the default rule is specific performance, which could explain the lack of legal scholarship on the subject, but this lack is also observed in the United States, where the default rule is an award of expectation damages.3 While at first sight, they seem opposed, I have demonstrated that the United States and French case laws are, in fact, less apart from each other than their respective legislation would lead us to believe.4

In this article, I will present the literature review (II.), the methodology used (III.), the hypotheses (IV.), and finally, the empirical results from a single variable and then multivariate linear regressions (V.).

III. Literature Review

In a previous article,5 I demonstrated that there is abundant literature on the theory of liability in contracts in both the United States and France. However, this same literature is much sparser concerning damages, and it is practically nonexistent on the quantum of damages. While this is unsurprising in French civil law, where the default rule remains specific performance,6 the same occurs in international commercial law and even in the United States, where the default rule is the award of expectation damages.7 However, the doctrine and jurisprudence have been less hesitant to deal with this in other areas of civil liability, particularly in torts. If initially the idea of organizing different types of bodily injury into rubrics and damages schedules seemed offensive, today it is fully accepted.

In the 18th century, Sir William Blackstone had suggested that the default rule applicable to torts should also be applicable to contract damages.8 While the literature is scarce in this area of the law, for each of the jurisdictions and bodies of law considered, it is still necessary to review it before developing the methodology used in the present article.

1. Theories and Case law in United States Law

In the United States, for a long time, and especially since the 1992 litigation of Goodstein Construction Corp., et al., v. The City of New York,9 it has been consistently ruled that the breach of an agreement to negotiate couldn’t result in the compensation of expectation damages.10 Even if, and when, agreements to negotiate were enforceable (for example, in California, Delaware, Illinois, New York, and Washington), the recovery would typically be limited to reliance damages. Titan Inv. Fund II, LP v. Freedom Mortg. Corp., a more recent case by the Delaware Supreme Court,11 indicates a different approach. In it, it was decided that Delaware would award expectation damages for the breach of an agreement to negotiate under some circumstances: “failure to negotiate a deal based on a non-binding but detailed term sheet could result in full damages as if the parties had signed up a deal.”12

The United States case law on this topic has seen an interesting evolution in the last few years. The question of the enforceability of statements made during the negotiation period, and before any contract is concluded, under section 90 of the Restatement of Contracts has been raised in particular in Coley v. Lang13 and Hoffman v. Red Owl Stores.14 Generally, courts believed that preliminary statements were not enforceable when they were so incomplete as to fail the standard set for enforceable promises by section 2 of the Restatement, which states, “so made as to justify a promise in understanding that a commitment has been made.”15 Therefore, courts were reluctant to use the promissory estoppel of Section 90 —“[a] promise which the promisor should reasonably expect to induce action or forbearance of a definite character on the part of the promise and which does induce such action or forbearance is binding if injustice can be avoided only by enforcement of the promise” —16 considering that the parties prefer undertaking the risk of losing their expected profits rather than the risk of having to compensate the lost profits of their counterparty in case of a breakup. In some cases, as in Coley v Lang, the parties explicitly stated that no statement made before the conclusion of the contract shall be binding.17 Notwithstanding the isolated Hoffman v Red Owl Stores case, courts typically require a clear, definitive, and unambiguous promise to consider it binding.18

If, nevertheless, the parties have agreed upon the key elements of the future contract, a modern approach seems to confer this preliminary agreement a binding force.19 This approach originated in Judge Leval’s opinion in TIAA v Tribune Co.,20 which distinguishes between two types of agreements. Type I preliminary agreements are clearly and entirely binding, for the parties agree upon all the important elements, but also express the desire to formalize their agreement in a separate contract later.21 This type of agreement seems to correspond to Section 27 of the Restatement.22 Type II preliminary agreements are those through which parties agree on some important elements of the future contract, but not on all of them, explicitly relying, on future negotiations for their determination. These agreements are typically formalized as letter of intent or protocols of agreement.23 Once the existence of a type II agreement is established, parties are under an obligation to continue the negotiations in good faith. According to one theory, bad faith can be characterized in these circumstances if both parties agree to invest simultaneously in continuing the negotiations, but one party refrains from further investments, waiting for the other one to “reveal” itself before terminating the negotiations.24 However, this theory is not accepted by all the commentators, especially by Victor P. Goldberg who argues that the obligation to negotiate in good faith was useless in Brown v Cara.25

The interesting question, however, is what kind of damages the plaintiff could hope to recover if the defendant acted in bad faith in terminating the negotiations. The observation of the case law points towards a general trend. First, reliance damages are typically recovered.26 Second, consequential damages (such as damages to reputation) may be recovered, but the evidence of such damages is often very difficult.27 Finally, expectation damages may be recovered if all the terms of the agreement have been agreed upon in a detailed term sheet, such that it is possible to understand what the final agreement would have looked like,28 and the parties would have concluded the final agreement if the defendant didn’t breach the agreement to negotiate in good faith.29 An example of this type of allocation of damages comes from the case known as Columbia Park,30 where the Court held that even if development option agreements were simply agreements to negotiate, the plaintiff could recover not only reliance but also expectation damages, as it has not been proved by the defendant that the negotiations would have failed had it not been for the defendant’s bad faith. Therefore, the tribunal concluded that all the expectation damages that could be proven with reasonable certainty could be recovered. A similar conclusion has been reached by the Supreme Court of Delaware, which concluded that the obligation to negotiate in good faith is enforceable and that the plaintiff can recover reliance as well as expectation damages if this agreement is breached.31 In this last case, a term sheet for a pharmaceutical license had been negotiated, but the two parties had written a “non-binding” notice on both of its pages; the term sheet had been attached to two further contracts, which explicitly required the parties to negotiate in good faith an agreement close to the term sheet.32 The Supreme Court concluded that the parties were under an obligation to negotiate in good faith a license close to the one described in the term sheet; therefore, the defendant breached his obligation by insisting on very different terms,33 and the Supreme Court considered that the plaintiff could recover expectation damages in the form of a fair payment that he would have received had the agreement been finalized.34 This approach sets the US and French legal systems apart.

However, it is also interesting to note that some researchers have interested themselves in the anchoring effects of compensatory damages. Diamond et al. shows that a very large ad damnum may exert a boomerang effect, leading to such a negative impression that compensation may start to diminish.35 However, Marti and Wissler showed that the boomerang effect is not strong: when mock jurors were provided with traditional jury instructions (for example, to disregard the ad damnum), the effect did not appear at all.36 In that study, the only factor that reduced the final award was providing jurors with a range of verdicts in similar cases.37 In a recent study, Campbell et al. showed, conclusively in my opinion, that ad damnum, even when it is very high, has a very powerful anchoring effect, overwhelming the credibility effect for high amounts; in fact, the authors of the study concluded that no response strategy was effective against high-value anchors.38

Finally, it has also been argued by some researchers, in a different field of analysis, that the judges “may be less willing to grant a higher compensation ratio for larger claimed compensation amounts, all other things being equal, simply because they are reluctant to award large sums.”39 This might be because large claims are more likely to be inflated by the claimant than are small ones.40 Accordingly, some have argued that a “moral” consideration may be factored in the judicial decision when extremely high damages are awarded to the plaintiff. That seems to contradict the statement according to which judges are reluctant to award large sums. In such outlier cases, I find courts often mention the defendant’s opportunism41 or bad faith to justify their departure from the full compensation principle. Somewhat similar biases to the ones my results point to were also uncovered by previous studies of human cognition. Chapman and Bornstein showed, for instance, that asking for exorbitant amounts of damages creates negative perceptions of the plaintiff, making her seem selfish and less generous (which doesn’t preclude, however, the award from being higher because of the anchoring effect, on which more will be said below).42 While I agree that my results may show that judges and jurors are reluctant to award large amounts, I am not convinced that the explanation lies, as Choi seems to suggest, in their disbelief as to the reliability of the evidence provided in favor of the claim.

2. Theories and Case Law in French Civil Law43

The French legal literature on the definition of damages for contractual breach and especially on the calculation of the quantum of these damages is sparse. One reason for this scarcity may be that the assessment and award of damages are questions of fact and not questions of law. Therefore, they are left for researchers in the fields of economics and statistics. From a legal point of view, all damages shall be compensated, as long as they are direct and certain. This is why, as put by Laurent Aynes, “there is no relevance in law . . . to identify different categories of prejudice . . .. No definition of economic loss exists in the law or the doctrine.”44 However, “in spite of the general scope of the full compensation principle, a hierarchy between bodily injury and economic loss (detrimental to the latter) has appeared in recent laws and court rulings.”45

The Cour de Cassation is increasingly demanding on the motivation of trial judges’ decisions, but it doesn’t constrain them on the selection of the types of damages considered or the valuation method used. In fact, “the trial judge justifies the existence of the prejudice by her own evaluation, having no obligation whatsoever to detail the elements she used to determine the quantum.”46 This type of reasoning creates a strong incentive for trial judges not to over justify their decisions and not to go into a detailed evaluation, to decrease the chances of the decision being reversed.47

Therefore, the general principle of full compensation is too broad to provide an adequate valuation method. Moreover, it appears that its traditional understanding, “civil liability aims at putting the victim back in the position where she would have been had the damage not occurred,”48 precludes judges from compensating future loss through expectation damages, by limiting the compensation to the “certain loss actually incurred by the plaintiff, solely and directly because of the breach and predictable from the defendant’s point of view.”49 When the French judge is uncertain about the incurred damage, she typically uses the theory of the “lost chance”: “compensation for the loss of a chance shall be measured to the chance lost and cannot equal the advantage the chance would have produced if it materialized.”50 However, the trial judge is still free to determine the quantum of compensation.51 Overall, French judges appear to be particularly reluctant to grant damages up to a specific point and it could, therefore, be argued that a so-called “ceiling effect” is present in the French jurisdiction, specifically in the context of the doctrine for punitive damages. 52

Concerning the question of agreements to agree and agreements to negotiate, it should be noted that the new Civil Code—effective from October 1st, 2016—codifies important judicially created rules.53 Under the new articles, the negotiations are free but have to be conducted in good faith. Moreover, damages in case of the breach of this duty cannot compensate the profits expected had the contract been concluded.54

Before the 2016 reform, judges would generally admit the recovery of the fees related to the negotiation like travel fees55, research, and legal fees.56 What is interesting, however, is that judges would also compensate plaintiffs for their reputational harm,57 as well as for the harm done by possible breaches of confidentiality. Importantly, they would also admit the compensation of the lost chance to negotiate and conclude a similar contract with a third party, mostly in cases where the length and breadth of the negotiations were but a tactic used by the bad faith defendant to stop the plaintiff from concluding a different contract.58 As such, these cases seem to fit the “negative interest” theory, according to which the plaintiff has to be put in the same situation as she would have been had she not started negotiating with the defendant.59

Arguably, the most emblematic case concerning the damages that could be compensated if the negotiations are broken before the contract is concluded is the Manoukian case,60 in which the Cour de Cassation defines in great detail recoverable damages. The Court defines lost profit as: 1) reputational damage precluding the conclusion of a similar contract with a third party, 2) the lost chance to conclude a contract with a third party, 3) the lost profits expected from the conclusion of the negotiated contract, and 4) the lost chance to gain something from the contract.61 While the first two parts of the definition are not problematic, as I have already seen, the Court rejects any reparation of the last two harms. The Court explains that as long as the contract hasn’t been concluded, the defendant could only be liable under tort law, in case of misconduct.62 In other words, the fact that the contract was not completed precludes the compensation of lost profits as defined in the third factor; tort rules cannot be used to achieve the profit awaited from the conclusion of the contract.63 As for the damage defined in the fourth factor, the Court concludes that it cannot be recovered, for the cause (in the notoriously difficult sense of the French cause) of the lost chance cannot be the decision to stop the negotiations, which is protected by the freedom to conclude or not a contract.64 However, the lost chance to profit from a contract can be compensated if a pre-contractual agreement has been concluded in a preliminary phase of negotiations. This agreement, which is a contract itself, could give rise to the defendant being contractually liable.65 Naturally, the extent of this liability depends on the terms of the pre-contractual agreement. The Manoukian case is still positive law, and its conclusion has been repeated on multiple occasions since 2003.66

As it should be clear by now, for all its precision, the Manoukian case law does not provide an exact way to determine and to calculate the quantum of the awarded damages in case of breach of negotiations. As a factual question, this calculation is left for the trial courts, which are rarely clear about the methodology used. As I will show, however, my empirical analysis points to some general trends and strong correlations, which somehow allows predicting the outcome.

3. Theories and Case Law in International Commercial Law

Tools for the harmonization and standardization of international commercial law, such as the United Nations Convention on Contracts for the International Sale of Goods (“CISG”)67 and the UNIDROIT Principles of International Commercial Contracts (“UNIDROIT Principles” or “PICC”),68 are similar to French civil law, both in that they fail to define “full recovery” and in that all types of losses are recoverable. The CISG and the PICC permit recovery for non-pecuniary damages. On the other hand, the CISG draws on Anglo-American common law concerning recovery for indirect loss of profits and the duty to mitigate damages. I shall use the PICC as the reference for the analysis below.

ARTICLE 2.1.14 (CONTRACT WITH TERMS DELIBERATELY LEFT OPEN)

(1) If the parties intend to conclude a contract, the fact that they intentionally leave a term to be agreed upon in further negotiations or to be determined by a third person does not prevent a contract from coming into existence.

(2) The existence of the contract is not affected by the fact that, subsequently

(a) the parties reach no agreement on the term; or

(b) the third person does not determine the term, provided that there is an alternative means of rendering the term definite that is reasonable in the circumstances, having regard to the intention of the parties.

In an ICC Arbitral Award of 1998, the arbitral tribunal used article 2.1.14 of PICC, considering an agreement had been found between the parties on the main terms and conditions:

In the side letter, the Parties agreed on the principle of the license agreement, on the fundraising and its quantum, hence they agreed on the main terms and conditions of the license agreement . . . The mere fact that the Parties intentionally left some provisions to be agreed upon in further negotiations . . . does not prevent the license agreement from being executed.69

ARTICLE 2.1.15 (NEGOTIATIONS IN BAD FAITH)

(1) A party is free to negotiate and is not liable for failure to reach an agreement.

(2) However, a party who negotiates or breaks off negotiations in bad faith is liable for the losses caused to the other party.

(3) It is bad faith, in particular, for a party to enter into or continue negotiations when intending not to reach an agreement with the other party.

In an ICSID Arbitral Award of 2007,70 the claimants invoked Art. 2.1.14 of PICC in support of their view that the concession contract awarded by the respondent was a valid contract despite the open terms, and the tribunal ruled to this effect. The respondent argued that in light of Art. 2.1.15 of PICC, there was no obligation to reach an agreement or liability for failure to do so.71 The tribunal found no evidence of bad faith in the negotiations but did find evident negligence in the handling of the negotiations and, consequently, that the fair and equitable treatment standard under the United States-Turkey investment treaty had been reached, awarding compensation for the claimant’s investment expenses, also known as reliance interest.72 Although this judgment does not deal with a case governed by the PICC, it does show that pre-contractual liability can arise for negotiating the open terms of a contract in a manner contrary to good faith and fair dealing. The judgment seems to interpret bad faith restrictively, but it has been shown that in Art. 2.1.15 of the PICC bad faith must be understood as contrary to good faith and fair dealing, so it should include cases of negligence.73

The notion of ‘losses’ is more restrictive than that of ‘harm’ used in Art. 7.4.2 of PICC. However, the rules governing damages for non-performance may be applied by analogy to situations where the right to damages arises during the pre-contractual period (Art. 2.1.15, 2.1.16, and 3.2.16). The agreement could range from a basic agreement to negotiate to a more complex one. Common types of commercial preliminary agreements are letters of intent, memoranda of understanding, heads of agreement, and agreements in principle. Their binding nature and enforceability vary depending on their content, and their treatment varies in national systems.74

Illustration to Art. 2.1.15 of 2004 PICC75 suggests that, in practice, the duty to negotiate in good faith may be the subject of an express agreement between the parties, in which case full remedies for breach of contract might be available. Full remedies here mean compensation for both the reliance/negative interest (i.e., the expenses incurred to negotiate the contract and the lost opportunity to conclude another contract with a third person) and the expectation/positive interest (i.e. the profit that would have resulted if the negotiated contract had been concluded). The availability of these remedies would be a good reason for expressly agreeing to negotiate in good faith. Failing to do so will limit liability to the protection of the reliance/negative interest as is consistent with the general trend in national systems.

What the parties need to know, however, is how much exactly they could expect to get or to pay in case the negotiations are breached in bad faith. Expectation damages are generally calculated using the differential between the contract price and market price at the time of the breach. Unfortunately, none of the considered laws offer clear guidance as to how to calculate (compensatory) expectation damages when there is no market price referential. My empirical analysis sheds some light on the various methods operating within the three jurisdictions and, interestingly, on methods that are common between the three bodies of law. The next section details the methodology used for the empirical analysis.

IV. Methodology76

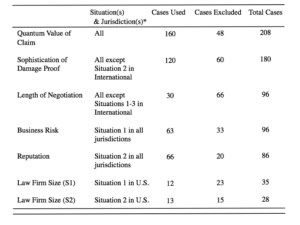

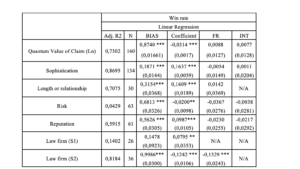

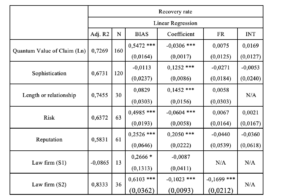

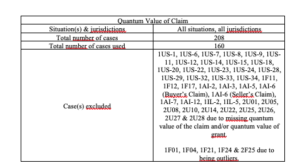

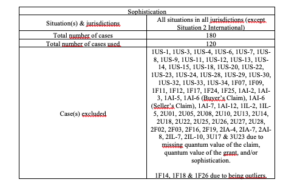

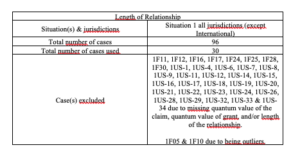

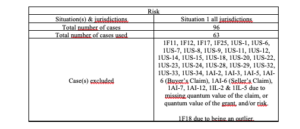

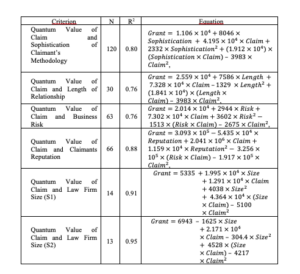

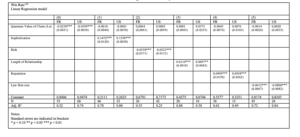

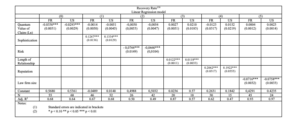

In this part, I have studied the grant outcome, considered either as the win rate or as the recovery rate, as a function of the different criteria: the 1) quantum value of claim, 2) claimant’s methodology sophistication, 3) length of relationship, 4) risk related to the claimant’s business, 5) importance of reputation for the claimant’s business, and 6) claimant’s law firm size. Not all the studies are presented here, but tables 6 and 7 below show the different coefficients for each analysis from a linear regression model.77 Different criteria from the claimant’s side—the quantum value of claim, sophistication, risk, reputation, and law firm size—are individually assessed in this part of the analysis. I assess the effect of each criterion on the grant through two outcome functions: the effect of the criterion on the win rate and the effect of the criterion on the ‘unconditional’ recovery rate (i.e., the recovery rate on all cases).78

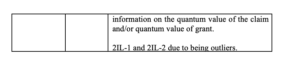

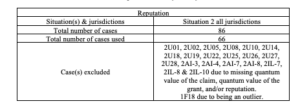

The comparison of the recovery rate function is made mainly considering two measures of statistical validity: the coefficient of determination and the sample size used to represent the explanatory power and reliability of the functions. I also use the first derivative to reflect whether the impact on the grant is positive or negative and its slope to determine how much the size of such an impact grows as the criterion reaches its higher values. Not all of the data can be used in the analysis. Information on the data sample — including the situation(s) & jurisdictions(s), the total number of cases, the total number of cases used, and case(s) excluded — for each criterion is provided in the tables presented in appendix.79

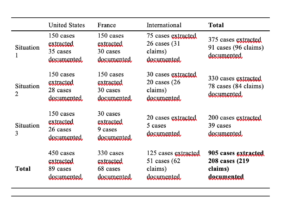

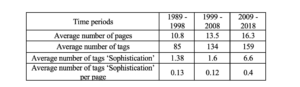

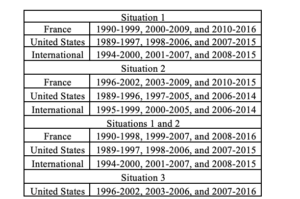

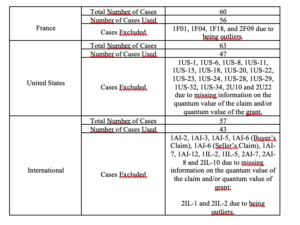

My research aims to identify any trend or pattern in the damage compensation that a court would grant for a contract breach in each of and across three jurisdictions: The United States, France, and international commercial law. In examining compensation, I was concerned primarily with recoverable damages, or losses that were reasonably, certainly, and foreseeably incurred as a result of a breach in an agreement. Using existing literature and professional experience, I developed several hypotheses as to how the courts and judges decide on damage compensation. I then determined what data variables I needed to collect from case law to confirm, disapprove, or amend my hypotheses. I collected 905 cases (dated from 1989 to 2016), but only 208 cases (or 219 claims) were fully documented in the database, and hence for those, I was able to extract both qualitative and quantitative data. In doing so, I categorized the cases under three kinds of situations—denoted as Situation 1, 2, and 3. Situation 1 was assigned to cases in which there was a breach in an agreement to negotiate or to agree. Situation 2 was assigned to those in which there was damage to goodwill, business reputation, brand, or image. Situation 3 was assigned to those in which there was a loss in profit or opportunity for new businesses. All three situations involve circumstances where the damages are difficult to quantify. While Situation 1 and 2 applied to all three jurisdictions, Situation 3 applied only to the United States where the New Business Rule evolved to allow for damage compensation to un-established or recently founded businesses.

Table 1: Summary of Contract Breach Cases Extracted and Documented from 1989 to 2016

I used two main metrics to quantify the outcomes, a “win rate” and a “recovery rate”. The win rate refers to the probability for a claimant to be granted any number of compensatory damages by the court. In cases where the claimant wins, I generated a recovery rate, which represents the proportion of their claim quantum that is granted by the court. I performed several successive analyses with these calculations. First, I focused on the overall trends of the outcomes over time in each and across the three jurisdictions. Then, I considered the different criteria that could influence the outcomes.

1. Methodological Challenges to Research

1.1 Sample Size Limitation

To my knowledge, this research represents the first attempt amongst comparative lawyers to systematically measure contractual damages. Although I gathered 905 cases dated between 1989 and 2016, I was only able to manually code data from 208 of them in my research.80 This sample could be considered relatively modest in size compared with the abundance of case laws. This lack of documentation could be indicative of the legal community’s limited interest in quantitative analysis, a challenge presents equally in the United States, France, and international law. Over time, I may be able to overcome this difficulty in sample size limitation as more advances are made in the development of analytical technologies and the availability of information on public or private legal databases. Having discussed the size limitation, I can now move on to the discussion covering the potential biases in selecting the cases.

1.2 Selection Biases

From a theoretical standpoint, since Priest and Klein 1984 publication on the subject,81 I am aware of the fact that cases that get carried to court do not necessarily constitute a representative sample of all disputes that take place. However, recent studies concerning this matter have given nuance to this conclusion: Klerman and Lee82 have argued that while selection effects do exist, they are partial and still allow for valid inferences to be drawn from the percentage of plaintiff trial victories. Hence, as Schweizer established, “empirical analysis confined to data from litigated cases seems possible and fruitful despite the selection effect.”83 In addition to having tolerance against this effect, in theory, I can embrace selection bias in the particular context of this research.

The first selection bias is the fact that since my selected disputes are litigated, they are arguably the ones in which the involved parties face the highest degree of uncertainty. Because those parties have very different expectations about the potential outcome of the litigation, they are less likely to settle. However, it is precisely these cases that I am interested in, as the objective of my analysis is to determine ways to reduce judicial uncertainty.

The second selection bias that I have considered in my research pertains to the comparative component of the analysis. The United States, France, and international commercial law are characterized by different proportions of commercial disputes that are litigated and those that are settled out of court. The common knowledge is that a majority of commercial disputes are settled out of court in the United States. The proportion of settlements is probably lower in France, given the cost of litigation is lower. Comparing international commercial law to the United States and France adds another layer of complication to the analysis. For example, the inclusion of a liquidated damages clause in a contract reduces the number of cases that continue to the verdict stage.84 However, the potential difference in the share of litigated cases between the jurisdictions should not affect the validity of the conclusions that I am drawing from the observations on the sample. As explained above, for the first selection bias I focused primarily on litigated cases and their outcomes (as opposed to non-litigated cases and their outcomes) in the three jurisdictions.

An obvious third selection bias arises from the fact that not every litigated case is necessarily published online. This is especially true regarding the first instance cases. This is the reason why the sample is mainly composed of appeal and last resort cases. On the one hand, this bias seems to have reduced over time, as a greater proportion of cases are collected and then published in major databases. On the other hand, the only way to definitively address this issue would be to manually access all the dockets of the jurisdictions under investigation. This is, unfortunately, out of my current scope and means. However, this opens up a potential venue for future research.

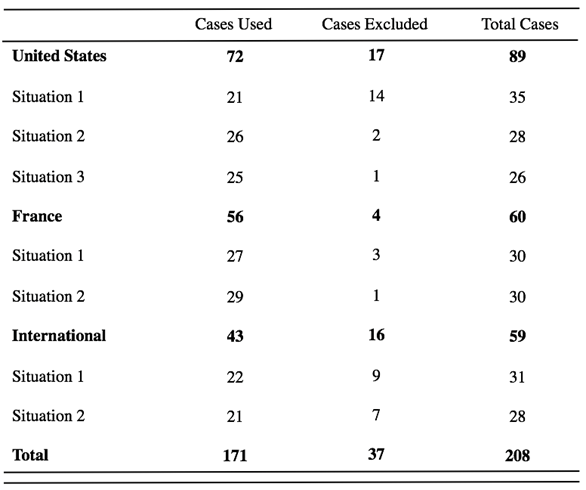

2. Sample Description85

Of the 208 documented cases representing 219 claims, I excluded another thirty-seven, for three different reasons. First, I excluded the cases of Situation 3 for France and international commercial cases as they were very few, and the analysis was mainly relevant for the US anyway. Indeed, Situation 3 relates to the New Business Rule, which is not a very common concept in France and International jurisdictions. Therefore, including cases of Situation 3 in those two jurisdictions would have resulted in a very biased sample, not representative of the general opinion of the jurisdictions on the matter. Second, some cases were missing information about one or more parameters (e.g., quantum value of claim, quantum value of grant). The specific cases that I excluded varied depending on the particular section of my analysis that I was conducting.86 Third, I excluded cases that were outliers to improve the explanatory power of my regression models.87

Table 2: Summary of Sample Used in the Analysis of the Convergence Amongst the Jurisdictions

Table 3: Summary of Sample Used in the Analysis of the Different Criteria88

To compose the database, I first extracted 150 cases per situation per jurisdiction through keyword searches in legal databases. This allowed me to compute the win rates on this large sample of cases. Next, another sample of around 30 cases per situation per jurisdiction was extracted. This latter sample was overbalanced towards cases granting damages to analyze my hypothesis concerning the factors influencing the decision to grant damages and the final recovery rate. I have nonetheless kept some cases where damages were not granted in this second set to assess what factors might explain these decisions. Also, the database is mainly composed of appeal cases in the United States and France. For international commercial cases, the sample is composed evenly of international arbitration cases (53%) and international litigation cases (47%).

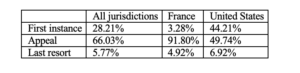

Table 4: Repartition of cases according to the level of court

2.1 United States

Out of the resulting sample for Situation 1 of 35 cases,89 I found eleven cases granting damages (31%). Out of the resulting sample for Situation 2 of 28 cases,90 twenty-six have been used. In my data set, three outlier cases have been separately identified and analyzed.91 Isolating these three cases, several trends seem to emerge. In what follows, I will present my main results and try to find specific explanations for the United States. Then, out of the resulting sample for Situation 3 of 26 cases,92 twenty-five have been used.

2.2 France

Out of the resulting sample for Situation 1 of 30 cases,93 I found twenty-one cases granting damages (70%). In Situation 2, I have extracted a sample of thirty cases94 and excluded only one.

2.3 International Commercial Law

Out of the thirty-one selected cases in Situation 1,95 twenty-two present a quantified claim and grant. In Situation 2,96 this figure is approximately the same—21 out of 28. The body of law was generally the CISG, from which cases were found through the UNCITRAL Case Law Database or Pace University Law Database on CISG cases. For international contract damages, I extracted cases based on two criteria: relevancy to my research and the presence of metrics that I could use. I did not select cases on whether damages were awarded or not. The discrimination in the process based on quantified claims is conscious. This selection necessarily biases the sample towards cases with more actual damages awards since the appellate courts may have felt it necessary to describe the original claims when giving a numerical award. The bias is acceptable for my purposes because I am primarily interested in why awards are being granted and how claimants get to a higher recovery rate.

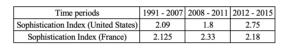

3. Trends Overtime in Each Jurisdiction

In my first analysis, I measured and compared how the jurisdictions each evolved in their total win rate and recovery rate over time. I visualized simple trend lines out of these calculations and observed whether the jurisdictions respectively increased or decreased in their grant values from one time period to the next. I calculated these measurements based on three-time ranges that I established for each jurisdiction. To avoid producing skewed results, I prioritized equalizing the number of cases that fell under each of the time ranges for each jurisdiction. As a result, the jurisdictions, which varied in the number of cases they provided in the data, were assigned three similar but slightly different sets of time ranges. Moreover, I assessed the degree to which these trend lines converged over time. In other words, the degree to which the jurisdictions progressed towards a similar win rate and recovery rate.

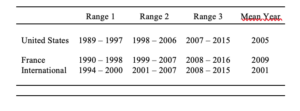

Table 5: Time Ranges Used for Analysis of Convergence Between Jurisdictions

4. Criteria Influencing the Outcome Across Jurisdictions

In my next analysis, I determined the relative weight that certain aspects of a contract breach lawsuit could have in explaining the compensation that the court would grant a claimant for recoverable damages. While working with the data, I took note of various parameters that commonly described contract breach cases across the jurisdictions. I concentrated on six of these factors after identifying which seemed most relevant to the court’s decision-making on the damages award appropriate to a particular lawsuit.

First, the quantum value of claim is defined as the amount of money the defendant declares as their damages. It is measured in thousands of United States dollars or euros and is not scaled. The grant was defined as two different percentages: the probability of grant, or win-rate, and the grant to claim ratio or recovery rate. Win rate is the probability for a claim to be granted. The grant to claim ratio, also known as recovery rate, is the proportion of quantum of claim being granted.

Time was measured in years and divided into three relatively equal ranges of years for each jurisdiction in Situation 1 and 2 combined. As described in the previous section, the win rate and recovery rate were calculated over time and compared by jurisdiction to evaluate possible convergence towards a common value. They were also calculated over time and compared by situations in each jurisdiction. Grant was defined as two different percentages: win rate, also called the probability of grant, and recovery rate which is also known as grant-to-claim ratio, which is the proportion of the damage claim received for the cases that were granted. Also, I define the win as either $0 (no grant) or more than $0 (grant). In the same way, the recovery rate studies the grant as being defined as the amount of money awarded to the claimant including legal fees.

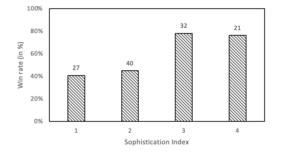

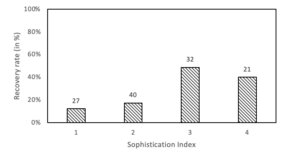

Then, the sophistication of the claimant’s methodology is the degree to which the claimant justifies the quantum value of claim that they seek for damage compensation. It is scaled from 1 (the lowest) to 4 (the highest). In scaling the sophistication of damage proof, I came up with a standard for each level indexed from 1 to 4. Level 1 was assigned to cases in which the claimant makes a single claim without any discernible basis. Level 2 was assigned to cases in which the claimant makes multiple claims based on different heads but does not provide any further explanation. Level 3 was assigned to cases in which the claimant makes claims based on different factors and provides simple justification (e.g., only qualitative). Level 4 was assigned to cases in which the claimant makes claims based on different factors and provides sophisticated justification (e.g., both qualitative and quantitative), possibly including an expert witness report in their initial complaints.

The business risk is the degree to which the claimant’s business performance is volatile. It is scaled from 1 (lowest) to 4 (highest). In order to classify the cases on a risk scale, I extracted data based on qualitative elements. For instance, I classified each case depending on the claimant’s industry type (distribution, service, high tech, manufacturing, and construction). I have attributed a claimant’s business risk index to each case about multiple factors (industry type, market price volatility, tenure of operations, size of the business). This index ranges from 1 (very low risk) to 4 (very high risk).97 All recovery rates seem to be constant, at around twenty-five percent.

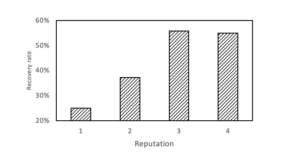

The reputation is the degree to which the claimant’s business performance depends on its reputation or image. It is scaled from 1 (lowest) to 4 (highest). I attributed a Claimant Reputation importance index to each case. I constructed this index with regards to how influential is the claimant’s reputation on their business.98 This index allowed us to attribute a rating to each case.

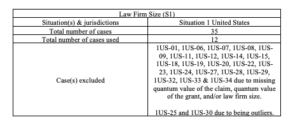

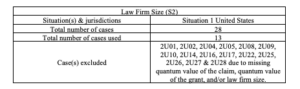

The law firm size is the size of the law firm that represents the claimant in court. This size is measured by the number of attorneys working at the law firm. It is scaled from 1 (very small) to 4 (very large). The analysis has been conducted in France and the United States. For France, I selected only Situation 2 in this part due to the extreme variation of the quantum value of claim in Situation 1 in my different categories that could have biased my results. As France and the United States are very different markets for law firms, I have adapted the threshold for the different sizes accordingly.99

For the United States, the thresholds are the following:

Very Small: local law office with less than five lawyers

Small: national law office with less than 100 lawyers

Large: major national law firm with over 100 lawyers

Very Large: major international law firm with over 300 lawyers

On the other hand, the thresholds for France are slightly lower:

Very Small: local law office with one lawyer

Small: local law office with two lawyers

Large: National law office with less than fifty lawyers

Very Large: major law firm with over fifty lawyers.

Finally, the length of the relationship is the duration of the claimant and the defendant’s contractual relationship or, alternatively, negotiation to reach a contract. It is measured in years and is not scaled. I first measured how each criterion was correlated with the damage award amongst the cases for which I was able to retrieve the necessary pieces of information. As the sample is only 207 cases, some criteria are studied only in a few cases. If not statistically representative, this empirical analysis is still interesting to detect some trends and highlights the need for a broader analysis, maybe using AI techniques. Using the graphical features of Microsoft Excel, I formulated single-variable functions in which a criterion was inputted as the regressor, and the grant (either the win rate or the recovery rate) was outputted as the outcome:

Win rate as a function of [criterion]

Recovery rate as a function of [criterion] 100

Per each criterion, I developed equations for these two functions to approximate the direction and the extent to which it weighed into the damage award that a court granted to a specific case. I worked towards both simplicity and explanatory power in creating these regression models. I sought to minimize the number of terms in the equation while ensuring that the coefficient of determination (R2) was significant.101 I then compared the equations for the second function to identify the relative impact that the different criteria have in explaining the damage grant.

5. Types of damages

The data for the United States shows conclusively that reliance damages are generally better compensated than expectation damages. To test my initial hypothesis, I designed a ratio by adding the amounts of granted damages for both types of damages, dividing the obtained sums by the sum of claimed damages for both types of damages.102 All the damages considered here are those awarded to the plaintiff.

The results show that almost all cases claiming reliance damages are granted some damages, with an overall recovery rate of 46%. This is not surprising: courts grant reliance and restitution damages, as those are easier to calculate and constitute obvious and uncontested damages for the plaintiff. It should be noted, however, that the average reliance damages claim ($0.6 million) is also much lower than the average expectation damages claim ($62 million). A certain reluctance to grant too large of amounts when confronted with uncertain calculations might explain the corresponding difference in the recovery rates, the average reliance damages grant being of $0.5 million and the average expectation damages grant being of $21 million.103 I also observed that one out of three cases in which the plaintiff claims expectation damages provide for some damages, with an overall recovery rate of 20%.104

Generally speaking, expectation damages represent the largest claimed number of damages. In fact, EGD represents 76% of the claimed amount, and reliance damages represent only 24%. The proportion is reversed for the granted amounts:105 only 26% correspond to EGD, while 74% correspond to reliance damages. The explanation seems intuitively simple. On one hand, reliance damages are easily proven, as they represent the damages incurred because of the investments made by the plaintiff in reliance on the contract performance. Expectation damages, on the other hand, are difficult to prove and subject to great uncertainty.106

As I will see below, an increase in the quantum of claim strongly correlates with a decrease in the recovery rate. It turns out that, while RD in my French dataset were claimed for an average of €1.4 million and a median of €121 thousand, EGD were claimed for an average of €14.5 million and €496 thousand, and ECD were claimed for an average of €5.4 million and a median of €765 thousand. This might, therefore, give an additional explanation for the observed discrepancy between the recovery rates of the different types of damages in my dataset. The data shows that the recovery rate for RD was 93% in all but one of the cases granting 100% of the claimed damages. For EGD, the recovery rate was 29%, while most ECD claims failed, except for one outlier case, Pavie v Mazars-Pavie et Associes.107

V. Hypotheses

There is a certain consistency for basic metrics, win rate and recovery rate especially, and the convergence overtime between the upward French trend and the downward United States trend towards similar rates. However, in some cases, a wide deviation from those average metrics exists. To explain the deviation, I propose the following hypothesis.

The first intuition is that there will be a negative correlation between the quantum of the plaintiff’s claim and the recovery rate.108 Alongside this arithmetic view, I also suggest more substantial intuitions. First, when claiming compensatory damages, it is expected that plaintiffs will encounter a psychological ceiling: the court will agree to grant compensatory damages only up to a specific point. It is expected to encounter this ceiling, especially in France, where the courts are even more reluctant to grant damages.109 Second, it is plausible that the higher the quantum value of claim, the more likely the defendant is to feel threatened and, hence, will protect its interests by spending more time and money on the case. Furthermore, the anchoring effect is expected to affect the compensatory damages granted by the court.110

The second intuition is that there will be a positive correlation between the quality of the plaintiff’s demonstration and the successful outcome of the case. The more the plaintiff will develop on their methodology by using sophisticated financial and economic valuations methods for instance, the more likely the judge will be tempted to grant their demand. Generally speaking, sophistication refers to the level of effort put into one’s demonstration. It thus concerns the claimant in their claim for damages, the defendant in the evaluation they make of what they should be liable for, and the court in the effort it puts to explain its final award. As a result, I hypothesize that the more sophisticated the plaintiff’s claim, the higher the grant. A third intuition may be that the length of the relationship between the parties before the breach will impact the outcome: the longer the pre-contractual negotiation or the contract itself, the more the judge will be likely to award damages. Indeed, the courts could be tempted to compensate for the effort made into the relationships as well as the time and resources devoted to it.

The intuition regarding law firm size is simple: the larger the law firm is, the more costly its services are and thus better results in litigations should reasonably be expected. If that intuition turns out to be too simplistic, it may be nuanced by taking into consideration the specific expertise of the law firm. According to the contract and economic theory, it can be expected to see judges reward the risk taken by companies. As such, the hypothesis would be that claimants operating in riskier industries are granted more money. Finally, I expect well established and highly renowned corporations to be compensated greater for any harm to goodwill, brand image, or commercial reputation.

VI. Empirical Results

In this part, I analyze the effect of the criteria on the grant, considered either as the win rate or the recovery rate. The first part will study the evolution of the grant over time in all three jurisdictions considered (1). Then, I will analyze the effect of each of the criteria, taken individually, on the grant (2). Last, I will conduct an analysis examining the effect of the criteria of the analysis along with the quantum value of claim to verify the reliability of the results obtained in the previous subsection (3).

1. Convergence Over Time Between Jurisdictions

In a previous article, I have established a striking convergence between jurisdictions over time.111 The objective of the present analysis is to identify the individual trends on grants in the three different jurisdictions (France, the United States, and international commercial cases (“International”)) and observe the evolution over time in each jurisdiction.

1.1 Observations

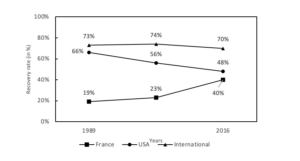

As it has been previously held, I can see that the convergence between jurisdictions is clear, especially between France and the United States. While the international jurisdictions stayed steady, the recovery rate in France doubled over time, and the United States decreased by a third. The average recovery rate was as low as 19% in the late 1980s/early 1990s and increased over time in France. On the other hand, it was as high as 66% in the late 1980s/early 1990s and declined over time in the United States. Although the average recovery rates in France and the United States experienced opposite trends over time, they both converged towards a percentage between 40% and 50% in recent years.

Fig. 1: Evolution of the recovery rate (in %) (N = 99 out of 123 cases)

Desegregating the results by situation leads to the following observations:

In the United States, the average recovery rate was as high as 85% in the late 1980s/early 1990s and declined over time in Situation 1. It was as high as 54% in the late 1980s/early 1990s and declined over time in Situation 2. On the other hand, it started as low as 20% in the late 1980s/early 1990s and increased over time towards 50% in Situation 3.

In France, the trend over time was similar to that in the United States in Situation 3. However, the average recovery rates approached mid-40s% to low-50s% in recent years in all three situations. In international law, the average recovery rate started at 74% in the late 1980s/early 1990s and converged towards 50% over time in Situation 1. It did not follow any trend in Situation 2 at all. However, the average recovery rates neared low-50s% in recent years in both situations. The observation of clear converging trends in terms of win rate and even more so of recovery rate between the United States and France—and to a lesser extent with the international commercial law—has led to the hypothesis that globalization is also operating in this field. To validate the hypothesis, I have documented the globalization among corporations, law firms, and also among lawyers. The conclusion is quite clear and confirms my initial hypothesis.112

1.2 Globalization113

In the previous article, I argued that service providers such as law firms, investment banks, and accounting firms are global and tend to provide a standardized service.114 The doubt that remains is whether it is safe to infer that judicial decisions and arbitration awards are also likely to adopt a certain global pattern.

There are good grounds to support such a statement. In common law countries, courts are required to follow precedents or to distinguish their decision, for which they must prove that the specific case is somehow different from the precedents of the court. In civil law countries, although precedents are not binding, they serve as a good indication of which direction the decision of the court should be based upon. Hence, if the issues and their defenses become standardized, I could infer that their outcomes would follow the same path. A question that arises is whether it would be too bold to infer that judicial decisions and arbitration awards tend to become more “predictable,” as they would likely fit into a certain category among other pre-established categories. Such a hypothetical decision-making process would undermine the possibility of sudden changes in case law, but it would become a simpler, more efficient “check-in-the-box” process as well as a quicker, shorter, and cheaper one. I performed the analysis of trends separately for each of the jurisdictions to check and confirm a possible convergence trend.

1.3 The Trend in the United States

The first relevant trend is the general decrease in win rates. I have observed a decrease from 33% in the first analyzed period to 26% in the third one. While the data provided is not sufficient to warrant a general conclusion about the tendencies of the United States case law, it is consistent with the findings of previous studies in related areas. For instance, Lahav and Siegelman showed that the plaintiff’s win rate in adjudicated civil cases in federal courts fell from 1985 till 2009 from 70% to 35%.115 The win rate started falling around 1985 and did so until 1996, then slightly increased and then stayed the same from the early 2000s onward.116 The authors considered several possible explanations of this dramatic fall, rejecting most of them.117

Interestingly, a somewhat similar trend may be observed in securities arbitration in the United States. As shown by Schultz,118 while claimants prevailed in fifty-three percent of awards from 1997 to 2002, they prevailed in only forty-three percent of awards in 2005, forty-two percent in 2006, and thirty-seven percent in 2007. There does not seem to be a readily available explanation for this decline, but it is consistent with findings related to the effect of the selection of arbitrators with prior experience representing brokers.119

Whatever the particularities of the data set in these studies, the results seem to point to a general trend without an immediate satisfactory explanation. In the words of the authors of one of the cited studies, “a significant puzzle remains unresolved.”120 As I have shown above, if the falling win rates are combined with a decline in the recovery rates, there could be a more general pro-defendant shift to be explained.

Data conclusively show that there is a substantial decrease in the recovery rate in this particular scenario in the United States jurisdictions across the three periods: from 66% during the period 1989-2002 to 56% in 2003-2006 and finally 48% in 2007-2015. This trend, which is one of the main results presented in this paper, can only partially be explained in conjunction with the other trends. Particularly, it seems to be linked to a global increase in the average amounts claimed from twenty-five million in 1989-2002 to $89 million in 2007-2015. As I will show below, there is a strong negative correlation between the quantum value of claim and the recovery rate, even if the increase in the quantum value of claim translates into an increase in the quantum value of grant from five million to ten million respectively.

1.4 Trend for France

In contrast to the United States cases, the data shows that the recovery rate has consistently increased over time, from an average of 20% to 40% in 1985 and 2015, respectively. Moreover, the expectancy damages have followed, if not induced, the same trend. Indeed, splitting the dataset in three similarly sized samples of successive periods between 1990 and 2016, I observed an increase of the recovery rate from 30% to 34% and, finally, 40% for all the cases where expectancy damages have been claimed. This trend is the reverse of the one presented for the United States cases, but interestingly, the final recovery rate seems to be approximatively the same in both jurisdictions.

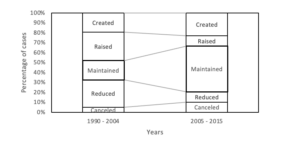

One might probably explain this evolution by a cultural shift in the perception of money in French society generally. Similar results for the UK prompted some researchers to look into a cultural and generational shift in judges as a possible explanation.121 It should be noted, however, that the data lends itself to such a cultural explanation, for there is an observable shift in the attitude of the Court of Appeal. In fact, within the dataset, over the period 1990-2004 the Court of Appeal reduced the quantum of 32% of the decisions. In the period 2005-2015, on the other hand, the data showed that these decisions seem to have been reduced considerably (12.5%). The Court rules, nowadays, more on the grant or no grant decision—overturning the decision in 40.5% of cases and confirming no grant decisions in 25% of cases—while also raising the granted amount in 12.6% of cases. Although some social and economic considerations could likely explain those evolutions, my intuition is that a certain cultural shift, deliberate or not, has taken place, at least at the level of the Court of Appeal. Indeed, while it has been considered in the United States in the seventies and eighties that grants were too lenient, therefore leading to a more reasonable number of damages, the trend is reversed in France; judges have been considered too conservative when it is a matter of money and damages and, as a result, they seem to be more and more likely to award higher grants. Further qualitative research is needed to confirm that hypothesis. This could also stem from the importance of the jury in the United States in the same period, while in France, only professional judges are operating in this type of litigation.

The next graph shows a clear evolution over time. Indeed, it seems that Courts of Appeal are nowadays more inclined to maintain decisions by keeping the grant steady, neither raising nor reducing it. If there is a cultural explanation as suggested above, it may be that a certain implicit harmonization has been reached between the two jurisdictions. The dataset is, however, insufficient to know whether this trend will be preserved over time or if it is only a temporary and accidental alignment.

Fig. 2: Evolution of the decision between the first instance and appeal in France (N = 42 out of 60 cases)

In sum, the data shows a clear evolution of both the win rate and the recovery rate. While trends in the United States and France go in opposite directions, they seem to converge around similar win rates and even more similar recovery rates. The explanations for these shifts may come in different forms. They are probably partly linked to different social and economic evolutions in these two jurisdictions, which are still to be uncovered. I do think, however, that the data motivates further research, primarily into the cultural evolution governing the decisions on liability and allocation of damages.

1.5 Possible explanations

Several researchers seem to point in the same direction, for instance, in the United Kingdom. Per Laleng, it suggests that the substantial fall of favorable outcomes for claimants in Court of Appeal cases—from 48% in 2002-2011 to 37.9% in 2012-2016—might be explained by a generational shift of judges.122 He was able to show that more experienced judges have a pro-claimant bias, which means that part of the evolution over time might be explained by their gradual replacement with a new generation of judges. I did not conduct a similar analysis over my data set, but it is a plausible hypothesis that the evolution might be linked to a generational shift; whether this is so should be further analyzed.

If a similar generational shift is observed in contract damage cases, however, its explanation may lie in the cultural perception of damages.123 For the United States, one significant discovery of previous research124 was that, at the end of the 1990s, a significant proportion of jurors had, despite empirical evidence to the contrary, the impression that there was a “litigation explosion” and “far too many frivolous lawsuits.”125 To conclude, all three jurisdictions converged towards similar levels of recovery rates, probably induced by the impact of globalization and other cultural or socio-economic factors. A detailed analysis has then been conducted on each of the considered variables, controlling for the effect of the claim each time it appears necessary.

2. Analysis

As it has been stated in the methodology section, the grant outcome is studied and considered as the win and recovery rates. The quantum value of claim, sophistication, business risk, reputation, and law firm size are studied successively. The next two tables present the results of the linear regressions for each criterion per the two usual variables, which are the win rate and the recovery rate. The first conclusion stemming from those results is that the jurisdictions do not, overall, dramatically impact the relationships between the win rate and the recovery rate and each criterion. The only exception to this is the impact of French jurisdictions regarding law firm size in Situation 2.

Table 6: Linear Regressions for win rate

Table 7: Linear regressions for recovery rate

Note: * p < 0.10, ** p < 0.05, *** p < 0.01

(Standard errors are indicated in brackets)

2.1 Quantum Value of Claim

To recall, the objective of the analysis is to identify the relationship between the quantum value of claim and the quantum value of grant in the three different jurisdictions (France, United States, and International) across all situations combined.126 In short, I want to demonstrate the impact of the claim on the grant following my initial hypothesis: the more the claim, the less the grant.

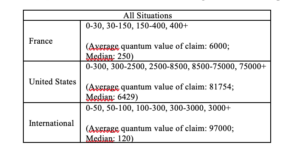

The quantum values of claims were measured in thousands and divided into ranges based on a relatively equal distribution of cases. The table below provides information on the ranges of quantum values of claim (in K$) for each jurisdiction across all situations combined. As cases are very different and not homogenous in the three jurisdictions, the ranges have been defined to take this fact into account and try, when it is possible, to compensate for this heterogeneity. Ranges have mainly been used for my continuous variables, which are the Quantum Value of Claim and the Length of Relationship.

Table 8: Quantum Value of Claims (in K$)

The initial hypothesis is the more the plaintiff claims, the relatively less she will be awarded by the judge. Indeed, I can formulate the hypothesis according to which the judge will be less likely to find a defendant liable if the claim is unreasonable. Therefore, and other things equal, the win rate should be reduced when the quantum value of claim increases. In other words, the win rate and quantum value of claim are negatively correlated.

Moreover, even if the grant value is influenced by several other criteria as shown below, the increase in the quantum value of the claim will, by definition and other things equal, reduce the recovery rate since the latter is defined as the value of the grant divided by the value of the claim. More than this simple mathematical observation, it is very likely that a judge could react negatively to a potentially unreasonable claim formulated by the claimant. I can also assume that in those situations, the defendant will be more aggressive in response to a claimant’s potentially excessive demand. If those hypotheses are verified, they demonstrate the importance of selecting the optimal value of claim to maximize the grant. Asking for more will not necessarily result in more grants for the plaintiff.

If I consider the three jurisdictions combined, I can remark that the quantum value of claim (in ln) is negatively correlated with the win rate by a coefficient of -0.0314. The same conclusion is valid for the recovery rate, with a coefficient of -0.0306. Both results have solid R2 and a reliable P-value below 0.01. More, as the quantum value of claim increases, the recovery rate, or the percentage of the quantum value of claim that is granted, decreases from about 50 % to slightly above 15 %. This study seems to verify my hypothesis, with a very high R2. However, the important part of the analysis is the comparative perspective, and this is the reason why I conducted the same computations on each jurisdiction.

The only researchers who investigated the link between what they called the implausibility index and the recovery rate—in tort cases only—seem to have shown that no significant link exists. Computing an index of implausibility by dividing the plaintiff’s pain and suffering ad damnum by the total for special damages claimed in the form of past and future medical expenses, lost wages, and property loss, Diamond et al. showed that there was no significant relationship between the implausibility index and the proportion of the amount requested by the plaintiff that the jury awarded for pain and suffering.127 Furthermore, there was no relationship between the index and the number of comments accepting the plaintiff’s ad damnum, using the ad damnum as a starting point, or recalling the ad damnum.128 This seems to be a counterintuitive result, as one could expect that higher claims simply seem less plausible, but my research seems to corroborate the results. While I am unable to reproduce the same idea in Situation 1, for it is not clear how to compute an implausibility index here, I did reproduce an analogous index for Situation 2, concerned with the harm to goodwill, business reputation, or image.129 Considering, as Diamond et al. did in their research, that the ratio between the damage on intangible assets and the total damage is a good proxy for the implausibility of a given claim for decision-makers, I calculated an index of implausibility by dividing expectancy consequential damages (ECD) claim by the total amount of damages claimed.130 If my index is a relevant proxy, then there is probably no strong relationship, as the R2 is as low as 0.09. It should be noted, however, that while judges, juries, and arbitrators are more reluctant to award high amounts, the anchoring effect of these amounts is still strong.131 However, Marti and Wissler showed that the boomerang effect is not strong: when mock jurors were provided with traditional jury instructions (for example, to disregard the ad damnum), the effect did not appear at all.132 In that study, the only factor that reduced the final award was providing jurors with a range of verdicts in similar cases.133 A recent study showed, conclusively in my opinion, that ad damnum, even when it is very high, has a very powerful anchoring effect, overwhelming the credibility effect for high amounts.134 In fact, the authors of the study concluded that no response strategy was effective against high-value anchors.135

These findings are consistent with my data, which shows that a larger claim is linked to larger awards; even if the average recovery rate fell, this evolution was accompanied by a rise in the amounts claimed and awarded. This suggests that the anchoring effect is robust, and I still lack a satisfactory explanation for the negative link between the claim and the recovery rate.

For the French analysis I do not have, compared to those on the United States, conclusive results since the coefficient is very small with a high standard error. Further research is therefore required to corroborate my hypothesis as to this negative link. In my sample, the win rate decreases from about 85% to 54% as the quantum value of claim increases. The recovery rate decreases from about 43% to 7%. Those results are not surprising. The French doctrine on damages is very reluctant to see judges award a huge amount of money to the plaintiff. That is to say, it is rare to see grants be more than just compensation for the actual loss that occurred. Also, it is worth noting that French cases are mainly appeal cases and always, in my study, judged by professional judges and not a jury. This could be a bias explaining why French cases have a lower quantum of grant.